Category Archives: Uncategorized

Home » Archive by categoryUncategorized"

Daily Cleaning Routine Part 1

- Nov, 26, 2023

- Adrienne

- household management, Managing your household, Sorting and Cleaning, Uncategorized

- No Comments.

A clean kitchen sets the tone for a harmonious home. By incorporating these daily cleaning practices, you not only maintain a hygienic environment but also create a space that fosters well-being.

Read MoreA Guide to Budget-Friendly Meal Planning: 1-Why Mastering Your Kitchen Inventory is so important

- Nov, 16, 2023

- Adrienne

- Budgeting, Budgeting in South Africa, Family, grocery shopping, household management, Managing your household, Meal Planning, Uncategorized

- No Comments.

Introduction: In budget-friendly household management and efficient meal planning, the often-overlooked hero is your kitchen cupboard and freezer. By maintaining control over these essential spaces, not only do you save money you also streamline your grocery shopping process. Let’s delve into the importance of kitchen inventory and how it can revolutionize how you approach your […]

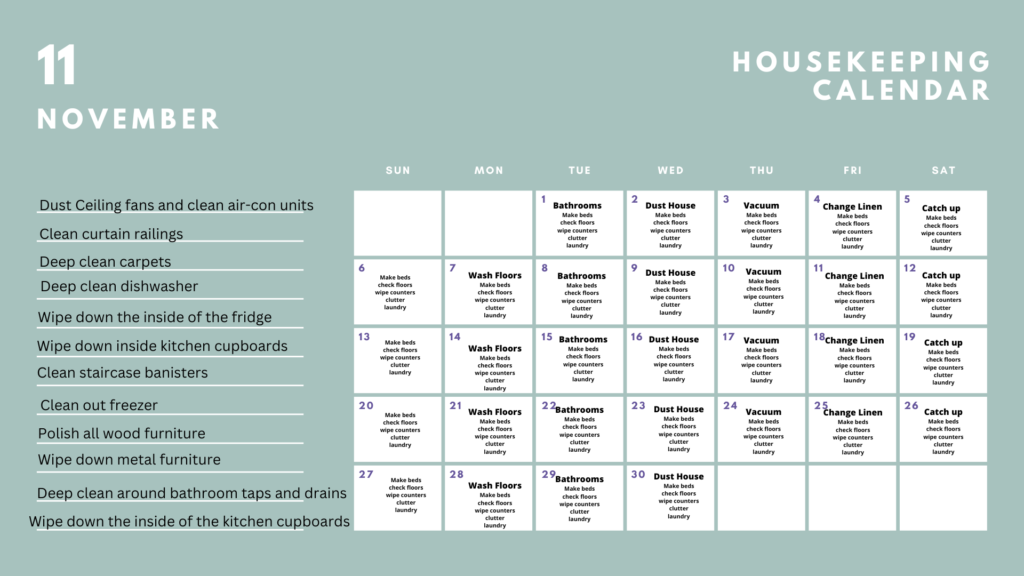

Read More3 Things to deep clean this November

- Oct, 27, 2022

- Adrienne

- cleaning schedule, household management, housekeeping, Managing your household, Sorting and Cleaning, Uncategorized

- No Comments.

Every month there are some things that you can deep clean in your home. There are also household cleanings that are done quarterly, twice a year or annually. Here are three things to deep clean for this month.

Read More5 steps to reverse meal planning

- Aug, 26, 2021

- Adrienne

- Daily budgeting for South Africans, household management, Managing your household, Meal Planning, Uncategorized

- No Comments.

Reverse meal planning? We have all heard about meal planning, but what is reverse meal planning? It is a great way to save time and money and keep your family fed at the end of the month. Covid has affected all our lives in one way or another. Many people have either lost their jobs […]

Read MoreStep 4 – What have you got?

- Jun, 21, 2020

- Adrienne

- Budgeting, Daily budgeting for South Africans, food, grocery shopping, household management, Managing your household, Meal Planning, monthly shopping, online shopping, Uncategorized

- No Comments.

What have you got in your cupboards today? You have set up your budget, found out what your family eats and drawn up your meal plan. It is time to go shopping. The first thing you need to do is to go shopping in your own cupboards https://kasheringyourlife.co.za/my-cupboard-adventure/. The best way to do this is […]

Read MoreGrocery Budget, the 2nd step to successful meal planning

- May, 06, 2020

- Adrienne

- Budgeting, Couponing, Daily budgeting for South Africans, Family, Finance, food, grocery shopping, household management, Lockdown, Meal Planning, monthly shopping, online shopping, personal finance, Uncategorized

- No Comments.

In step 2, it is time to work out your grocery budget. Grocery budgets will differ from household to household. These are unique to each family’s needs, size, and ages. How to create a grocery budget A big family will have a bigger grocery budget. A family with a baby will have a different budget […]

Beyond Lockdown, level 4. Can we survive?

- Apr, 26, 2020

- Adrienne

- Budgeting, Budgeting in South Africa, Couponing, Daily budgeting for South Africans, Finance, food, grocery shopping, household management, Lockdown, Managing your household, Meal Planning, monthly shopping, personal finance, saving money, South African, Uncategorized

- 1 Comment.

Lockdown continues As we head into the 6thweek of lockdown and move to level 4 it is time to think about what follows. https://www.news24.com/SouthAfrica/News/see-these-are-the-permissions-and-restrictions-for-level-4-lockdown-20200425 While we don’t know when lockdown will be lifted, life will definitely not be the same for a while. What happens after lockdown? It is an unknown chapter in our lives […]

Leaving home

- Jan, 31, 2020

- Adrienne

- Children, Family, Family Calendar, household management, Managing your household, Routines, Uncategorized

- No Comments.

Leaving home I am leaving home for a few days. I have the privilege of going to work in a kitchen at a 5-star luxury resort for a few days. Now leaving home for 3 days shouldn’t be a problem when I have 2 teenage children and 2 adult children, my husband and a domestic […]

Read More20 tips to a morning routine

- Jan, 13, 2020

- Adrienne

- cleaning schedule, Family, Family Calendar, household management, housekeeping, Managing your household, Organisation and clean up, Parenting, Routines, South African, Uncategorized

- 1 Comment.

Having a set routine will not do away with this altogether but it should reduce the morning mayhem significantly. I have previously written about creating a daily routine for children http://kasheringyourlife.co.za/good-mornings-and-good-nights/ and thought it was time to focus on the parents. I have thought about this carefully and even ‘mostly’ tested it myself during these […]

Read MoreSheets to the wind

- Nov, 04, 2019

- Adrienne

- cleaning schedule, household management, housekeeping, Managing your household, Organisation and clean up, Uncategorized

- 2 Comments.

5 sheets to the wind is usually an expression used when someone is very drunk. This is what I should have been when I read an article about how often you should wash your sheets. https://www.cnet.com/how-to/do-you-wash-your-sheets-enough-probably-not/ Changing your bed linen weekly is something I assumed happened in every home, apparently not! The recommendation is once […]

Read More- accident prevention

- App reviews

- babies in cars

- Books

- Braai

- Bread Recipes

- budget gifts

- Budgeting

- Budgeting in South Africa

- calendar

- Celebrations

- Cellphone safety

- Chanuakah

- Chicken recipes

- Child safety

- Children

- Chrismukah

- Christmas gifts

- Daily budgeting for South Africans

- Debt

- distracted driving

- driver safety

- drowning

- Environmental Issues

- Family

- Family Calendar

- Finance

- food

- Food for toddlers

- Food Myths

- Freedom Day

- frugal gifts

- grocery shopping

- Health

- heat exhaustion

- Heat wave

- Heritage Day

- household management

- I -Plan

- I-cook

- Jewish food

- JOFR

- Johannesburg

- Kosher

- Lockdown

- Managing your household

- Meal Planning

- Meat Recipes

- monthly shopping

- Nurses Day

- Obesity

- online shopping

- Organisation and clean up

- Parenting

- personal finance

- Personal safety

- pets in cars

- Public Holidays

- Quick meals

- Random Ruminating

- Recipes

- Religious holidays

- Reviews

- saving money

- School

- slow cooker

- Slow cooker recipes

- Soup

- South African

- Specifically Jewish

- Summer

- Teenagers

- textbooks

- texting

- Tu B Av

- Uncategorized

- Vegetarian Recipes

- Winter

- Workers Day

- workshop

- Xmas gifts

- November 2023

- October 2022

- August 2021

- February 2021

- January 2021

- November 2020

- September 2020

- August 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- May 2019

- April 2019

- February 2019

- January 2019

- November 2018

- October 2018

- September 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- August 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- October 2016

- September 2016

- August 2016

- July 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015