Tag Archives: Budgeting for South Africans

Home » Posts tagged"Budgeting for South Africans"

Beyond Lockdown, level 4. Can we survive?

- Apr, 26, 2020

- Adrienne

- Budgeting, Budgeting in South Africa, Couponing, Daily budgeting for South Africans, Finance, food, grocery shopping, household management, Lockdown, Managing your household, Meal Planning, monthly shopping, personal finance, saving money, South African, Uncategorized

- 1 Comment.

Lockdown continues As we head into the 6thweek of lockdown and move to level 4 it is time to think about what follows. https://www.news24.com/SouthAfrica/News/see-these-are-the-permissions-and-restrictions-for-level-4-lockdown-20200425 While we don’t know when lockdown will be lifted, life will definitely not be the same for a while. What happens after lockdown? It is an unknown chapter in our lives […]

6 key tactics for successful budgeting

- Jan, 24, 2020

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Family, Finance, household management, Managing your household, personal finance, South African

- No Comments.

Budgeting for a lot of people is not something they want to think about. When they do think about it, it creates anxiety and is filled with a lot of negative emotions. Some people though find creating a budget a positive experience. For them, budgeting is freeing. The first word that came to my mind […]

Read MoreHow envelope budgeting can reduce your stress

- Oct, 18, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Debt, Finance, grocery shopping, household management, personal finance, saving money, South African

- No Comments.

Envelope budgeting has been around for years. There is a good chance that if you asked an older family member they will have either done it or heard about it. I have mentioned envelope budgeting in a few articles in the past and again recently. It is recommended by financial gurus such as Dave Ramsey […]

Cash is King

- Oct, 11, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Debt, Finance, household management, personal finance, South African

- No Comments.

‘Cash is king’: If you always pay cash, you don’t get into debt. Somewhere along the way, this has been forgotten. I know I was aware of it before my children were born. Pay Cash My father never bought anything on credit except his house; I think my parents bought their first car on credit […]

Read MoreCan you manage your money effectively?

- Oct, 04, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, household management, Managing your household, Personal safety, saving money, South African

- No Comments.

Do you manage your money or does your money manage you? For some living from paycheck to paycheck is a difficult way of life, and often results in more month than there is money. Money in Money out When you do not manage your money properly this is what happens. Money comes in on payday […]

There are no quick fixes

- Sep, 20, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Debt, household management, personal finance, saving money, South African

- No Comments.

There are no quick fixes in getting out of debt. Whether you are doing it yourself or with an advisor, getting out of debt will take time. Depending on the amount of debt, it could take weeks, months or even years. Debt snowballing, quick method to small debt One of the quickest methods, when doing […]

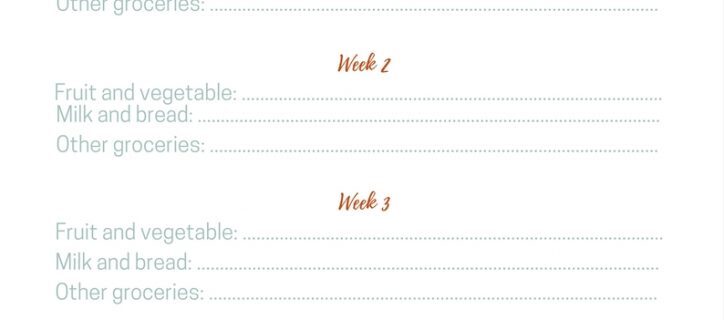

How to create a grocery budget

- Jan, 23, 2019

- Adrienne

- Budgeting in South Africa, Budgeting, Daily budgeting for South Africans, Debt, food, grocery shopping, household management, Managing your household, monthly shopping, personal finance, saving money, Uncategorized

- 1 Comment.

Creating a grocery budget is an important step to reducing debt How to start Before I even meet with potential clients, I ask them to estimate their monthly grocery bill. This includes not only food but also house cleaning products and toiletries. The reason for this is that we generally by all these products together. […]

Read More10 reason to grocery shop online

- Mar, 23, 2017

- Adrienne

- Budgeting in South Africa, Budgeting, Child safety, Daily budgeting for South Africans, Environmental Issues, Family, food, grocery shopping, household management, Managing your household, monthly shopping, online shopping, personal finance, saving money

- No Comments.

Here are 10 reasons to grocery shop on line. In June 2015 I started this blog and in the first article I spoke about how much I saved with online shopping. Nearly 2 years later, I can still say it is worth the hassle. Yes it was a huge learning curve on how to do […]

Are you honest?

- Oct, 11, 2015

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, household management, personal finance, South African

- No Comments.

Due to the Jewish holidays I haven’t been posting as I would like I and where we should be moving on to week 6, we are only covering week 4. Last post in the financial freedom series covered facing your money fears. This week we look at being honest about your money. You have analysed […]

Read MoreAre you Fearless?

- Sep, 21, 2015

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans

- No Comments.

In part 3 of this Road to Financial Freedom series, we will look at facing your money fears and changing them to positive statements. The truth is that we do need money to survive but we don’t need it to live. We spend our money on fixing things that are broken but we don’t fix […]

- accident prevention

- App reviews

- babies in cars

- Books

- Braai

- Bread Recipes

- budget gifts

- Budgeting

- Budgeting in South Africa

- calendar

- Celebrations

- Cellphone safety

- Chanuakah

- Chicken recipes

- Child safety

- Children

- Chrismukah

- Christmas gifts

- Daily budgeting for South Africans

- Debt

- distracted driving

- driver safety

- drowning

- Environmental Issues

- Family

- Family Calendar

- Finance

- food

- Food for toddlers

- Food Myths

- Freedom Day

- frugal gifts

- grocery shopping

- Health

- heat exhaustion

- Heat wave

- Heritage Day

- household management

- I -Plan

- I-cook

- Jewish food

- JOFR

- Johannesburg

- Kosher

- Lockdown

- Managing your household

- Meal Planning

- Meat Recipes

- monthly shopping

- Nurses Day

- Obesity

- online shopping

- Organisation and clean up

- Parenting

- personal finance

- Personal safety

- pets in cars

- Public Holidays

- Quick meals

- Random Ruminating

- Recipes

- Religious holidays

- Reviews

- saving money

- School

- slow cooker

- Slow cooker recipes

- Soup

- South African

- Specifically Jewish

- Summer

- Teenagers

- textbooks

- texting

- Tu B Av

- Uncategorized

- Vegetarian Recipes

- Winter

- Workers Day

- workshop

- Xmas gifts

- September 2025

- May 2025

- November 2023

- October 2022

- August 2021

- February 2021

- January 2021

- November 2020

- September 2020

- August 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- May 2019

- April 2019

- February 2019

- January 2019

- November 2018

- October 2018

- September 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- August 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- October 2016

- September 2016

- August 2016

- July 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015