Category Archives: Budgeting in South Africa

Home » Archive by categoryBudgeting in South Africa" (Page 3)

Every day saving tips for everyday South Africans

There are no quick fixes

- Sep, 20, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Debt, household management, personal finance, saving money, South African

- No Comments.

There are no quick fixes in getting out of debt. Whether you are doing it yourself or with an advisor, getting out of debt will take time. Depending on the amount of debt, it could take weeks, months or even years. Debt snowballing, quick method to small debt One of the quickest methods, when doing […]

Debt counselling, consolidation and mediation

- Sep, 13, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Debt, Finance, personal finance, South African

- No Comments.

Debt counselling, debt mediation and debt consolidation; these are words bandied about every day. Do you know what they mean? In Phumelele Ndumo’s book ‘Debt to Riches – steps to financial success’ she covers these topics in detail and in a way that is easily understood and, in my opinion, one of the first books […]

Read More10 Things I have learned about Budgets and Debt

- Aug, 16, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Debt, household management, saving money, South African

- 4 Comments.

Budgets and debt go hand in hand. Being in debt usually starts with you not having a budget. By the time you start thinking about a budget, your debt is often already well established. Over the years I have become an expert on being in debt and trying to create budgets! And in some months […]

Read MoreSay Wuhu to saving money

- Feb, 07, 2019

- Adrienne

- Budgeting in South Africa, Daily budgeting for South Africans, grocery shopping, household management, Managing your household, monthly shopping, personal finance, Reviews, saving money

- No Comments.

Wuhu Deals is my second favourite money saving app! Want to read more about coupons? http://kasheringyourlife.co.za/couponing-south-africa/ Wuhu Deals used to be known as Unilever Deals as it is their products on offer. The app has two ways to reward you. Either with a cash discount at the till or you can earn points towards airtime, […]

Read MoreHow to coupon in South Africa

- Jan, 28, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Debt, food, grocery shopping, Managing your household, Meal Planning, monthly shopping, personal finance, saving money, South African

- 14 Comments.

South Africa doesn’t coupon! We are far too advanced for that! We use apps! Most South Africans haven’t got time to sit and cut out coupons. I have to admit I do prefer the apps as we already have too much litter on the streets. Couponing helps you get your home sorted by making sure […]

Read MoreAre specials really special?

- Jan, 25, 2019

- Adrienne

- Meal Planning, Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, food, grocery shopping, household management, monthly shopping, online shopping, saving money, specials

- No Comments.

You see specials listed somewhere and think wow I should go buy those. I used to have that mentality, especially before I started meal planning. It cost me a lot of money in wasted food. Is it available at that price elsewhere? I have found sometimes that a favourite supermarket chain marks something like a […]

Read MoreHow to create a grocery budget

- Jan, 23, 2019

- Adrienne

- Budgeting in South Africa, Budgeting, Daily budgeting for South Africans, Debt, food, grocery shopping, household management, Managing your household, monthly shopping, personal finance, saving money, Uncategorized

- 1 Comment.

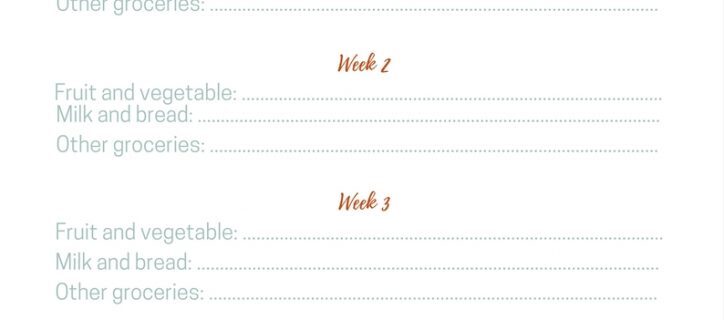

Creating a grocery budget is an important step to reducing debt How to start Before I even meet with potential clients, I ask them to estimate their monthly grocery bill. This includes not only food but also house cleaning products and toiletries. The reason for this is that we generally by all these products together. […]

Read MoreSnowballing year round

- Jan, 17, 2019

- Adrienne

- Budgeting, Budgeting in South Africa, Daily budgeting for South Africans, Debt, household management, Managing your household, personal finance, saving money

- No Comments.

Debt snowballing is a term used by Dave Ramsey to explain how to pay off debt. I have written about this before but it is such an amazing way to pay off debt. It may not be fast but it definitely produces results. As with creating a snowball from snow, you start off with a […]

The back to school rush

- Jan, 07, 2019

- Adrienne

- Uncategorized, Budgeting, Budgeting in South Africa, Children, Debt, Family, household management, Managing your household, Organisation and clean up, Parenting, personal finance, saving money, Teenagers

- No Comments.

The back to school rush is about to begin here in South Africa. Not only getting the last minutes supplies and textbooks but also checking to see that the uniforms still fit! If you are like me and have left everything to the last minute, the race and search for second-hand textbooks so that we […]

Read MoreBlack Friday or Red Holiday?

- Nov, 21, 2018

- Adrienne

- budget gifts, Budgeting, Budgeting in South Africa, calendar, Christmas gifts, Daily budgeting for South Africans, Debt, Family, grocery shopping, saving money, Xmas gifts

- No Comments.

Black Friday is one of the best times of the year for bargains and bulk shopping. Yet I have to wonder if it is worth the hassle? How much is too much Since it is right before payday, where does the money come from? Are businesses paying their staff early, or are people taking out […]

Read More- accident prevention

- App reviews

- babies in cars

- Books

- Braai

- Bread Recipes

- budget gifts

- Budgeting

- Budgeting in South Africa

- calendar

- Celebrations

- Cellphone safety

- Chanuakah

- Chicken recipes

- Child safety

- Children

- Chrismukah

- Christmas gifts

- Daily budgeting for South Africans

- Debt

- distracted driving

- driver safety

- drowning

- Environmental Issues

- Family

- Family Calendar

- Finance

- food

- Food for toddlers

- Food Myths

- Freedom Day

- frugal gifts

- grocery shopping

- Health

- heat exhaustion

- Heat wave

- Heritage Day

- household management

- I -Plan

- I-cook

- Jewish food

- JOFR

- Johannesburg

- Kosher

- Lockdown

- Managing your household

- Meal Planning

- Meat Recipes

- monthly shopping

- Nurses Day

- Obesity

- online shopping

- Organisation and clean up

- Parenting

- personal finance

- Personal safety

- pets in cars

- Public Holidays

- Quick meals

- Random Ruminating

- Recipes

- Religious holidays

- Reviews

- saving money

- School

- slow cooker

- Slow cooker recipes

- Soup

- South African

- Specifically Jewish

- Summer

- Teenagers

- textbooks

- texting

- Tu B Av

- Uncategorized

- Vegetarian Recipes

- Winter

- Workers Day

- workshop

- Xmas gifts

- September 2025

- May 2025

- November 2023

- October 2022

- August 2021

- February 2021

- January 2021

- November 2020

- September 2020

- August 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- May 2019

- April 2019

- February 2019

- January 2019

- November 2018

- October 2018

- September 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- August 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- October 2016

- September 2016

- August 2016

- July 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015